- Home

-

Catalogue

- Abstract of Labour Laws

- Administrative Law

- Advocacy

- Alternative Dispute Resolution ADR

- Anti-Corruption / NAB / Anti-Terrorism Laws

- Anti-Money Laundering Laws

- Arbitration Laws

- Arms & Explosives

- Assistant Collector's

- Audit

- Banking

- Bare Acts

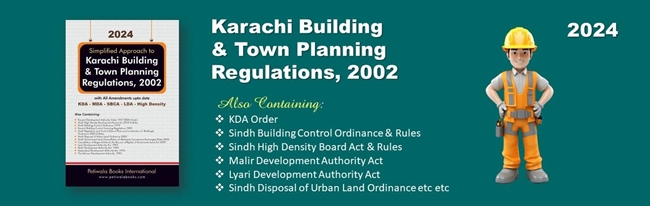

- Building / Land Laws

- Cantonment/Military Laws

- Children Laws

- Christian / Hindu Laws

- Citizenship - Foreigners - NADRA Laws

- Civil Laws

- Code of Civil Procedure (CPC)

- Code of Criminal Procedure (CRPC)

- Company Secretarial Practice

- Computerized Accounting

- Constitutional Laws

- Consumer Protection Laws

- Contempt of Court

- Contract Law

- Control of Narcotics

- Conveyance, Deeds

- Cooperative Societies

- Corporate Laws

- Court Fees & Suit Valuation

- Court Rules

- Criminal Law

- Cross Examination

- Customs

- Cyber Crimes - Anti Money Laundering

- Damages & Compensation

- Defamation Laws

- Dictionaries

- Dishonour of Cheque

- Drug Laws

- Easements Act

- Educational Laws

- Election Laws

- Electricity Laws

- Environmental Laws

- Equity Trusts

- Evacuee Trust Properties

- Excel

- Family Laws

- Federal Civil Service Laws

- Financial Analysis

- FIR & Complaint

- Foods Laws

- Foreign Exchange

- General Clauses Law

- Gift

- Government Publications

- Guardians & Wards Act

- Home Remedies

- Human Resource

- Human Rights

- ICAP Open Book

- Illegal Dispossession Laws

- Import Export

- Income Tax Guides

- Income Tax Laws

- Inheritance & Succession

- Insurance Laws

- International Law

- Interpretation of Statutes

- Islamic Banking

- Judicial Exam

- Jurisprudence (Islamic & Modern)

- Labour Laws (Federal etc)

- Labour Laws (SINDH)

- LAT (Law Admission Test)

- Law GAT

- Legal Practitioner & Bar Council

- Legal Research and Writing

- Letter Writing

- Limitation Laws

- Litigation

- LLB Guides Part I

- LLB Guides Part II

- LLB Guides Part III

- LLM

- Local Government Laws

- Major & Minor Acts

- Media / Telecommunication Laws

- Mental Health

- Mines & Minerals

- Motor Vehicles Laws

- Negotiable Instruments Laws

- Notices

- Pakistan Penal Code

- Partnership Law

- Petroleum & Mines

- Philosophy of Law

- Police & Prison Laws

- Power of Attorney

- PPRA Public Procurement Laws

- Professional Tax

- Property Laws

- Public Works

- Qanun-e-Shahadat

- Railway Laws

- Registration Laws

- Rent Laws

- Revenue Qualifying Examination

- RISK Management

- Sale of Goods Act

- Sales Tax & Federal Excise Laws

- Sales Tax on Services (Provincial)

- Shops & Establishments

- Sindh Civil Service Laws

- Sindh General Laws

- Societies Registration Law

- Specific Relief Laws

- Stamp Laws

- SUITS

- Tort Law

- Trade Marks, Coprights, Intellectual Property Laws

- Transfer of Property Laws

- Trust & Waqf Laws

- Women Harassment

- Writs

- WTO

- Zakat Laws

- اردو قانونی کتابیں

- Stationary

- About Us

New Arrival Products

Karachi Building and Town Planning Regulations, 2002 with Other Laws

Mohummed Asif Raza (Advocate High Court)

PKR: 4500

PKR: 4000

Top Books

Information

Copyright © 2020 Petiwala Books. All rights reserved.

Powered by nopCommerce

![Central Public Works [Department Code, Account Code & Book of Forms] Central Public Works [Department Code, Account Code & Book of Forms]](https://www.petiwalabooks.com/images/thumbs/0006768_central-public-works-department-code-account-code-book-of-forms.jpeg)